Illinois Medicaid Re-Invents Claims Management Lifecycle to Support Managed Care Payments

Payment model leverages X12 standards, transactional data, and analytics to reduce cycle times, increase revenue cycle management transparency

Like most state healthcare organizations with a large Medicaid population that are transitioning to managed care delivery systems, the state of Illinois initially encountered myriad challenges when processing provider claims through its contracted managed care organizations (MCOs). By 2019, a growing backlog of rejections and denials resulted in slow payments, putting financial pressure on Medicaid providers and creating administrative gridlock between the providers and MCOs to correct, resubmit, and otherwise process claims.

To shrink payment cycle times and increase revenue cycle management transparency, the Illinois Department of Healthcare and Family Services (HFS) sought to understand and evolve its claim management lifecycle to meet the more challenging demands of managed care. Specifically, the Centers for Medicare & Medicaid Services (CMS) goals:

- Deliver better care for individuals and populations

- Support integrated, person-centered care

- Control costs

HFS started by accessing the state’s repository of health claims data. Optum filled in resource gaps, providing a dedicated transactions specialist, who developed standardized workflows to build a cohesive reporting capability for HFS.

To derive insights from standards-based X12 data and modify the related workflows, HFS leveraged the power of analytics by engaging Optum to analyze how MCOs processed claims. Causes for rejections and denials were examined, along with how well providers were creating and submitting claims.

|

While managed care holds the potential to improve care coordination and quality for patients, it also creates a higher level of complexity that can result in payment errors. According to McKinsey & Company, new sources of complexity and error are:

|

Keys to success

Overcoming identified claims submission and processing challenges presented hurdles involving transaction and communication capabilities between providers and MCOs. Since each MCO adjudicates claims differently, information was often inconsistent, creating errors and requiring significant resources from all parties.

X12 processing challenges:

- Usage of delimiters due to inconsistent usage by MCOs and clearinghouses

- Tracking of 837 transactions to the 277 claim acknowledgement transaction

- Tracking of 837 and 835 transactions due to appeals and reversal of previous payments

- Operational challenges in implementing WEDI SNIP Type edits

- Plan specific Provider edits

HFS introduced a concept that optimizes operations with efficiency, consistency, and full transparency. Standardized claims formatting, grounded in proven X12 transaction standards, was essential to the program’s success and sustainability, delivering key benefits such as:

- Accuracy – Less risk of data entry errors and miscommunication

- Cost reduction – Automation to lower costs associated with manual labor

- Efficiency – Seamless transfer of electronic documents without compatibility or security issues

- Interoperability – Different billing, adjudication, and payment systems to communicate with each other, allowing users to send and receive transactions across different platforms

“Organizations that implement X12-based solutions have long recognized the value of using our EDI Standard to effectively engage with each other via electronic data interchange,” said X12 CEO Cathy Sheppard. "Now the state of Illinois is taking the standardized data to the next level, applying the power of analytics to fine-tune claims processing for managed care. This significant and exciting innovation is facilitated, in large part, by X12 standards that were already in place. Building this kind of ground-breaking solution on a well-established infrastructure maximizes the impact and reduces the costs."

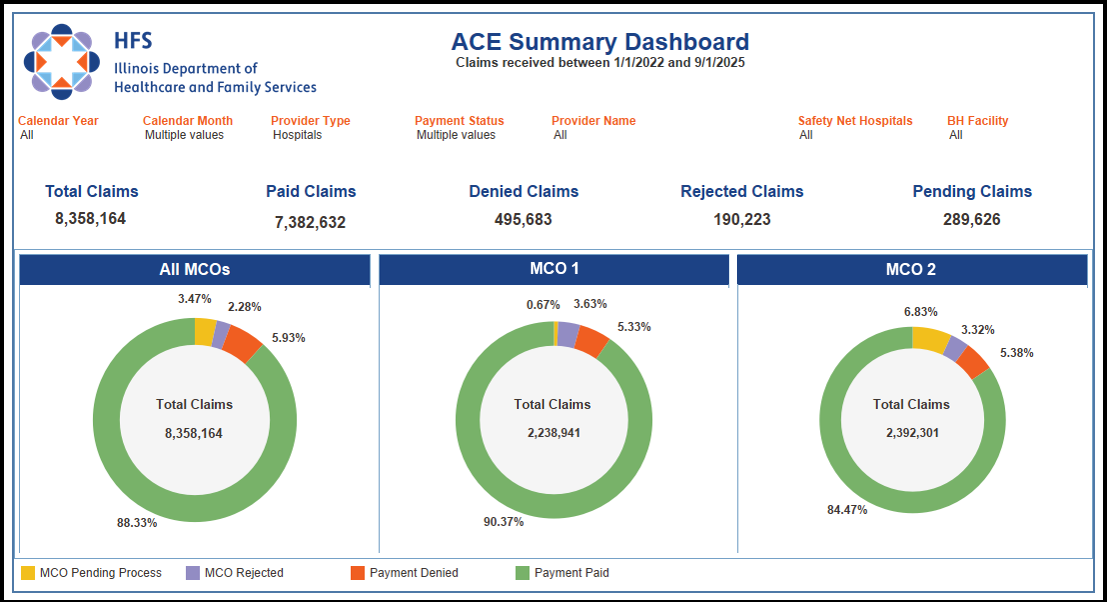

To integrate data in existing X12 transactions from multiple entities, HFS partnered with Optum and its Advanced Communication Engine (ACE) analytics platform. This collaboration made it possible to interpret and act on claims submission and processing data, in addition to encounter data; improve workflows; overcome staffing challenges; and create a cohesive reporting capability.

Pre-adjudicated claims, claims edits, claim acknowledgements, claim status requests, and remittance advice transactions were integrated into the Illinois HFS enterprise data warehouse (EDW), providing greater visibility, transparency, and analytic opportunities. These significant outcomes were shared with all stakeholders, helping to gain buy-in on corrective actions and resulting workflow changes.

Analyzing claims, payments, and related transactions to this level of specificity has allowed HFS to gain valuable insights. The X12 EDI transactions were used to identify trends in payment cycle times, payments, denials, and rejections with enhanced utilization management, thereby increasing patient quality and reducing administrative costs. Using the ACE dashboard also made it possible to review and reconcile MCO pricing and timeliness of claims adjudication, further improving transparency and accuracy.

Results

Using advanced analytics to evaluate standardized X12 transactions and improve workflows has resulted in real-time tracking and seamless denial management, increasing efficiency and transparency. Better understanding led to process improvements, including identifying data gaps and plan changes. These proactive measures and corrective actions have been validated and support key performance indicators (KPIs).

Thanks to these changes, the state of Illinois is now exceeding expectations, with 90% of claims being paid from the initial billing.

Just as important, the changes have vastly improved provider and payer relationships, leading to greater collaboration. Technological evolution continues to encourage open communications, easing staff frustration and conflicts. Detailed insights are informing ongoing education and decision-making.

Conclusion

Ultimately, any state agency can replicate the model implemented by the state of Illinois to improve its approach to oversight of managed claims processing. Both providers and patients benefit from the changes, making it easier for patients to access care and providers getting paid in a timely manner.

Building on this positive outcome, Illinois plans further improvements, including aligning standardized X12 encounter data from MCOs with ACE analytics to provide even more comprehensive insights. This advancement offers the opportunity for robust messaging and enhanced capabilities to identify and resolve more complex provider billing errors.

About the Illinois HFS

The Illinois Department of Healthcare and Family Services (HFS) is responsible for providing healthcare coverage for adults and children who qualify for Medicaid, and for providing Child Support Services to help ensure that Illinois children receive financial support from both parents. The agency is organized into two major divisions, Medical Programs and Child Support Services. In addition, the Office of Inspector General is maintained within the agency, but functions as a separate, independent entity reporting directly to the governor's office.

About Optum

Optum partners with states to advance their health and human services priorities through vision, innovation, and expertise. They bring deep experience in State Government procurement and deliver forward-thinking solutions that help drive progress in Medicaid and HHS initiatives. Their integrated analytics suite leverages advanced technologies, including artificial intelligence and machine learning—to improve risk and quality performance, increase user adoption, and expand access to self-service insights. Learn more at optum.com/stategov.

About X12

X12, chartered by the American National Standards Institute (ANSI) for more than 40 years, develops and maintains business-to-business data exchange standards to drive business processes globally. X12's diverse membership includes dedicated technologists and business process experts in health care, insurance, transportation, finance, government, supply chain, and other industries. X12's consensus-building forum enables members to meet regularly to develop syntax-neutral data exchange standards collaboratively. With more than 320 published transaction sets, 1,400 data elements, and over 40,000 codes available for use, the body of X12's work provides the foundation to support nearly every facet of business-to-business operations. Learn more about X12 licensing at x12.org/licensing.